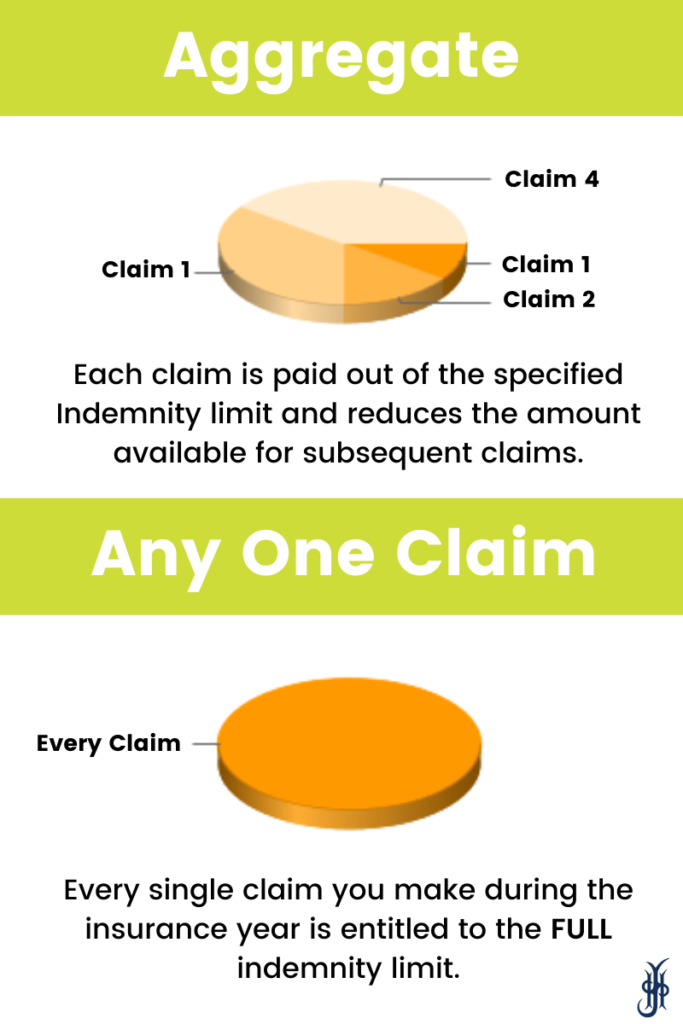

Professional Indemnity policies often appear to all be the same, offering similar levels of cover and generally covering the same twelve-month period. However, when looking at differing insurance policies, it is important to know whether cover is being provided for “in the aggregate” or “any one claim”. The amount of money that your insurer will pay out for a claim may differ greatly depending on these three words.

What Does “In The Aggregate” Mean?

Policies written and arranged on an aggregate basis, the “limit of indemnity” is the total amount that the insurer will pay out over a policy term for multiple claims. All expenses are paid out of that limit and once that limit has been reached, all cover ceases and future claims wouldn’t be indemnified by insurers.

Example of “In The Aggregate”

Lets say that you have a Professional Indemnity policy with a £250,000 limit of indemnity specified. Firstly, a claim comes in and insurers pay out £100,00 in damages to a third party. This leaves £150,000 to meet other claims. A second claim is then put in at the value of £125,000 and is again met by the insurers in full. When a third claim arrives and is indicated at £75,000, the insurers will only indemnify up to £25,000 of this claim as that is all that remains of the indemnity limit. The business therefore would be left to meet the outstanding £50,000 themselves.

What Does “Any One Claim” Mean?

When a policy is on an “any one claim” basis, then the insurance customer is entitled to the full limit of indemnity for every claim made. For this reason, “any one claim” is also frequently referred to as “per occurrence”, “per claim” and “each and every claim”. Unlike with “in the aggregate” where the cost of each claim is deducted from the total limit available, with “any one claim” policies each claim is allocated 100% of the indemnity limit.

Example of “Any One Claim”

Let’s use the same scenario referred to in the “in the aggregate” example above. Three claims are indicated throughout the policy year and in this case, all three are met in full by the Insurer. This means that the business does not have any outstanding liabilities to meet themselves and are fully indemnified by their insurers.

As you can see within the two examples that we have provided, the difference between the two basis of cover can be striking. Of course, “any one claim” basis is the ideal requirement. You do not have to consider financial difficulties if you have a particularly bad year in which your business faces multiple claims. The premium may be a little pricier, as you would expect, but it is certainly the safer option when it comes to claim settlements.

However, depending on the business type, an aggregate policy may be all that you need. Sometimes it’s only possible, due to the nature of a client’s business, to gain an aggregate policy. This may be due to higher perceived risk of a claim or poor claims history for example.

Check the Finer Details

The main point to take away from this is article is to ensure that you check the basis of cover when buying professional indemnity insurance – always question what cover you are being offered. The difference in terms of claims settlements can be substantial, yet in some case there is only marginal difference in annual premium.

If you have any further questions, please feel free to get in touch with a member of our team.